La Française Group has a solid track record spanning 45 years and is widely recognized by investors as a market expert.

As a committed stakeholder, La Française Real Estate Managers, the umbrella brand under which all of the group’s real estate activity is marketed, pursues the active management of its real estate portfolio in line with its responsible investment strategy.

To best meet the needs of its 120,000 plus investors - institutional and private investors - La Française Real Estate Managers offers a wide range of turnkey investment solutions tailored to their specific needs.

(outside of France)

(excluding France)

The group’s team of local real estate professionals, specialized according by business expertise and market, has largely contributed to its solid reputation among investors.

In 2016, the group fast-tracked its digital transformation by launching Moniwan, an online distribution platform of investment solutions that integrates a 100% digital subscription process. This development illustrates La Française Group's innovation strategy and demonstrates its ability to create new tools and services tailored to investors’ needs.

Recognised long-standing expertise

real estate asset managers (***)

(*) source: ASPIM: SCPI, capitalization at 30/06/2024

(**) Source SCPI IP Real Estate TOP 150 REAL ESTATE INVESTMENT MANAGERS, 06/06/2022, classified by assets under management

(***) 51st worldwide among leading real estate asset managers.

With its team of experts, La Française Real Estate Managers supports investors across the entire real estate value chain, from investment to asset management and value creation.

La Française Real Estate Managers has two sub-divisions, Retail and Institutional, which co-exist to better serve the diverse needs of its investor base.

Leading collective real estate investment manager in France

As the leading collective real estate investment manager in France, La Française offers private investors a complete range of real estate investment solutions. These solutions take the form of collective real estate investment vehicles (SCPIs and OPCIs for the general public) exposed to attractive market segments / themes: the office of the future, Greater Paris, Europe, Logistics, Healthcare. The group also offers tax-advantageous collective investment vehicles in residential property, as well as unit-linked investment solutions eligible in French life insurance contracts.

(commercial property)

eligible in French life

insurance contracts

specialized in vineyards

A renowned European real estate expert among institutional investors

La Française Real Estate Managers offers mandates (or club-deals), other dedicated fund solutions, as well as closed-end funds for a wide range of international clients across continental Europe, the UK and Asia.

Our investment solutions deal with promising and sustainable themes adapted to the diversification needs and risk appetite of our investors. LF REM is also recognised as a specialist in core and core-plus real estate investment strategies across Europe.

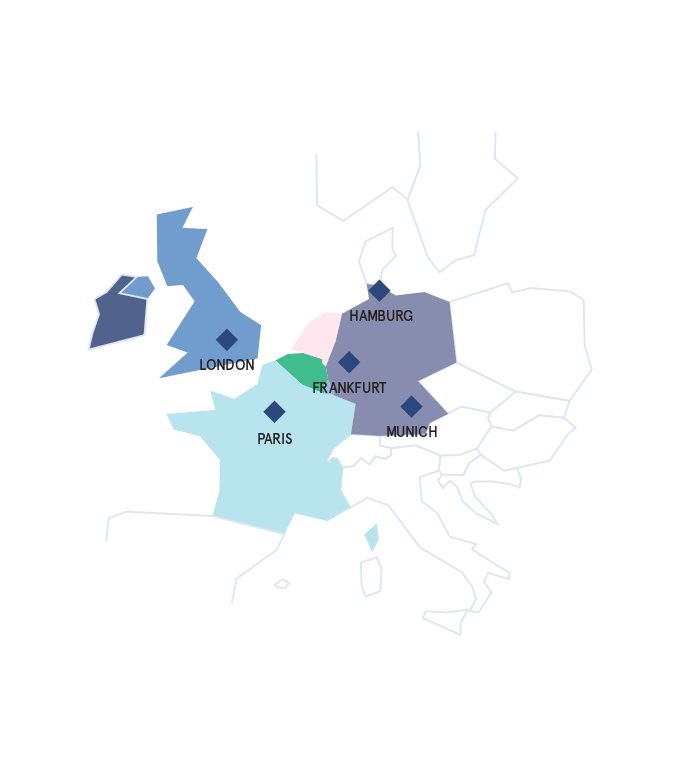

La Française Real Estate Managers provides a complete investment management service in both direct and indirect real estate combining expertise in sourcing, acquisition and investment. Thanks to our pan-European platform we manage quality assets in strategic locations in high potential markets from our local offices.

for approximately € 8 billion in assets

to institutional investors

In 2022, 24% of total real estate assets are managed on behalf of international investors (excluding France).

From the office in London we invest in the UK, Republic of Ireland, Belgium and Luxembourg.

From our offices in Germany we invest in both German cities and in the Netherlands.

Thanks to our offices based in Seoul and Singapore we are able to offer opportunities for Asian and Australian investors to invest in European markets.

A diversified portfolio of assets tailored to the needs of our tenants

With more than 1,900 assets, 10% of which are located in Europe, outside of France, La Française is active across all market segments, and currently has a strong presence in the office sector. In 2021, the group closed 45 acquisitions totalling 2.2 billion euros, of which 69% were offices.

To protect the value of its real estate portfolio, the group regularly and strategically opens up to other sectors. In this respect, La Française was a pioneer in the creation of Groupements Fonciers Viticoles. Our ambitions for diversification are currently focused on segments with a positive social impact, such as health care, as well as residential, managed residences (students and seniors) and last-mile logistics. Geographically, La Française has always favoured the core countries in Europe. The Group will continue to invest in capital cities but will not lose sight of regional markets, where the proximity of the asset to public transport is key.

La Française Real Estate Managers actiely manages its portfolios in order to address new user habits and requirements. To do so the asset manager has a three-pronged approach based on: SUSTAINABILITY, FLEXIBILITY/SERVICES and LOCATION.

In 2022, La Française Real Estate Managers created and launched a new services offer designed to suit tenant’s business requirements and needs for flexibility: Wellcome by La Francaise. The aim of the new service is to facilitate and enrich the tenant's user experience while optimising rental conditions: new innovative lease options and an exclusive benefits programme with “à la carte” services, negotiated with partners of La Française Real Estate Managers. Wellcome by La Française is operational for twelve assets and will be extended to the asset manager’s European office real estate portfolio..

Innovation at the service of our investors

For its retail investor client base, the objective is to simplify and democratise access to collective real estate investment vehicles, by making them more flexible and creating an open line of communication with the end investor.

Two examples are Moniwan, an online distribution platform of investment solutions that integrates a 100% digital subscription process and which is dedicated to retail investors, and Agil'Immo, a new innovative and flexible service launched in 2021.

![]()

Moniwan is a La Française Group brand and the first BtoC distribution platform to offer a new user experience with a 100% digital subscription process. In addition to the simplified access to a variety of investment vehicles , Moniwan offers innovative services and tailor-made tools specifically suited to neophyte investors.

Furthermore, La Française Real Estate Managers supports the "Ville de Demain" association (City of Tomorrow), whose aim is to assist real estate sector stakeholders in the digital and environmental transformation of the city through the development of start-ups in partnership with the HEC incubator.