by François Rimeu, Senior Strategist, La Française AM

For several months now, US anti-inflation policy measures have started to take effect. After peaking at 9.1%, US inflation has begun to drop, dipping to 5% in late March. However, a more detailed analysis is required to fully comprehend the current drivers of US inflation and any risks that may lie ahead.

A general consensus has been reached on the energy front: if energy prices remain at current levels, the worst is behind us. Gas prices have returned to where they stood prior to the Russia-Ukraine war and have even reached record lows. The price of oil remains significantly higher than in 2020 or 2021, but far from the peaks of June 2022. The surprise decision by OPEC+ countries to cut production by more than one million barrels per day from the beginning of May could cause a price rally. However, in our opinion, a number of factors should mitigate this risk, i.e., weak global growth, highly resilient Russian production and US strategic oil reserves. Ultimately, energy price inflation in the US (or deflation in this case), which stands at -6.4% (compared to 41.6% in June), is not a major risk in our opinion even if the negative base effects will likely fade away gradually; based on current energy prices, we anticipate that energy inflation will turn positive again around the end of 2023.

Food inflation, which dropped from 11.4% in August to 8.5% in March, is expected to continue its slow but gradual decline. Historically speaking, food prices have been closely linked to price changes in gas and fertilisers. Given that the latter have already fallen sharply, we believe that food prices are likely to continue to fall.

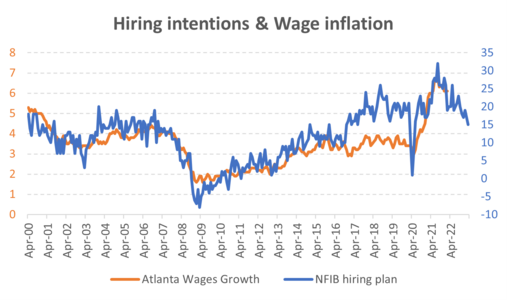

Service sector inflation is much more complex and is where Federal Reserve Chairman Jerome Powell is focusing his attention. Services inflation remains close to record highs at 7.1% in March, mainly due to the importance of real estate and more specifically to one of its largest components, Owners’ equivalent rent (OER). OER inflation however moves relatively slowly, and it could be several months before we see a significant fall. The Federal Open Market Committee has communicated widely on the fact that it analyses inflation without taking the "OER" component into account precisely because of this lag. Beyond the residential services component, there are other sectors to monitor closely, i.e., the transport sector, which is being hit hard by inflation (airfare in particular). Nevertheless, we believe these risks should gradually diminish as wage pressures subside. On this crucial point, the future seems to be less concerning for a number of reasons:

- Household purchasing power has stopped decreasing,

- Inflation expectations have been revised downward,

- According to the NFIB’s monthly job report, there is a declining number of planned new hires (See chart below).

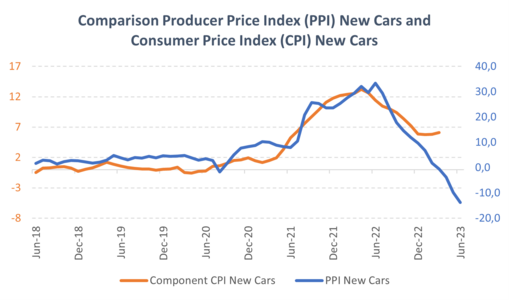

Goods inflation, at 1.5% over 12 months, does not seem to be of particular concern, After a sharp hike in prices due to temporary supply chain disruptions (Covid, Ukraine), price increases are more moderate. However, negative base effects are coming to an end (much like with the oil market), which could lead to a more complicated path moving forward for the Fed. The car market for example is of particular interest for several reasons:

- New car prices continue to rise at a rate of 6.1% over 12 months (to late March 2023). There are several reasons behind this: the ecological transition and the trend towards more expensive electric vehicles, tax incentives linked to the purchase of these vehicles, inventory issues persisting with certain models, etc. If we add to the equation excess household savings (which should be the case until the end of the year) and hence sustained demand, prices could remain high. Indeed, new car prices have been rising relative to wholesale prices for several months now, which is a sign of tension on this market.

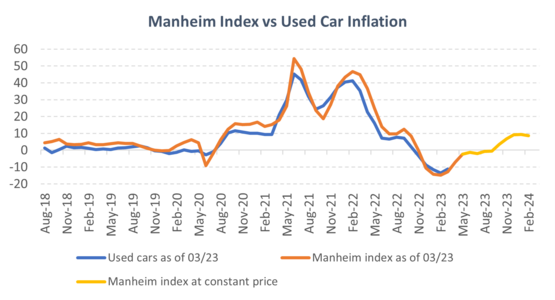

- The corollary of new car prices rising significantly (almost +50% since the pre-Covid period) is that used car prices are once again rising. New cars are unaffordable for many; hence inventories of used cars are down. It seems logical that we will see used car prices rising, and that this will be reflected in inflation figures in the coming months.

This may seem trivial, but cars represent 7.6% of the inflation basket, so this is an important point.

In the future, US inflation should experience disinflationary pressures coming from the services and food sectors and more inflationary pressures from energy commodities and goods. Goods inflation could therefore be the variable to watch during the 2nd half of the year, even though the current focus seems to be on services.

Data sources: Bureau of Labor Statistics

The information contained in this document is provided for information purposes only. The specific information, opinions and figures that are provided are considered to be well-founded or accurate on the date when they were drawn up and they reflect the La Française Group's current opinions regarding the markets and market trends. The information has no contractual value, is subject to change and may differ from the opinions of other management professionals. Published by La Française AM Finance Services, with its registered office at 128, boulevard Raspail, 75006 Paris, France, licensed by the ACPR (“Autorité de contrôle prudentiel et de résolution”) is an investment services provider under no. 18673. La Française Asset Management is a management company licensed by the AMF under no. GP97076 on 1 July 1997.