The Jackson Hole conference is now behind us and it marks both the end of the holiday season and the very likely start of the US Federal Reserve’s ratecutting cycle. Jerome Powell was very explicit, stating that “the direction was clear” and that “the time has come for policy to adjust”.

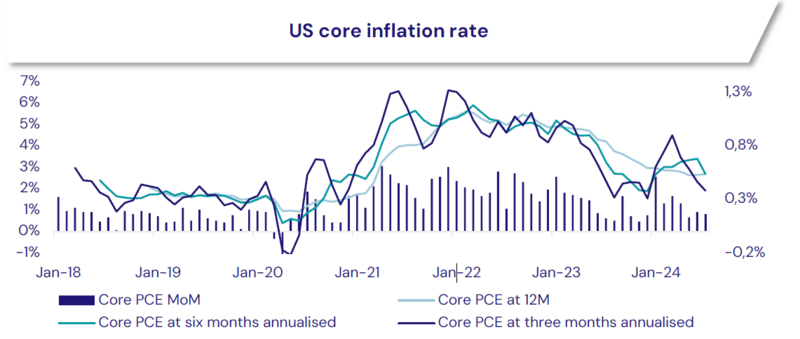

This announcement makes sense in light of the summer we have just been through. The drop in the price of a barrel of Brent oil from $84 to $78 on 23 August signals a brighter outlook for short-term inflation. In addition, the inflation figures published over the last two months have been reassuring, very much so in the United States, even if this remains somewhat less the case in the eurozone.

The latest US employment figures were quite disappointing and in August even induced a (short-lived) episode of panic in a market that in truth was sorely lacking in depth. Hence, we see no reason for the Fed o refrain from gradually reducing the restrictive nature of its monetary policy.

Are these generally disappointing figures from the summer indicative of an imminent recession? We think not. The eurozone is slowing down after a slight improvement in the 1st half of the year, but keeping its head above water thanks to the services sectors. The slowdown is also real in the United States, but the economy is nevertheless expected to maintain nominal growth of around 4-5% in the coming quarters, a pace one could only dream of in Europe. There are no significant updates to report from China at this time.. The health of the exporting machine allows them to hope for growth close to 5% this year.

Financial markets are anticipating a fairly aggressive cycle of rate cut cycle, particularly in the United States, with four rate cuts by the end of 2024, and eight in the following 12 months. We believe these expectations are overly ambitious given the state of the US economy. After all, there are still uncertainties about the future of inflation in the medium term, not to mention the potential consequences of the elections in the United States. The situation is obviously less true in the eurozone, where there are greater difficulties in the economic environment.

Download the PDF for more information