Completed on 18 | 05 | 2022

MARKET CONTEXT

The pace of growth in the major developed economies is currently showing signs of slowing down compared to 2021, without collapsing. The factors behind this recent change in momentum are mainly (i) the zero-covid policy in China which is penalising local consumption, supply chains and global trade more generally, and (ii) the Russian-Ukrainian conflict, which is intensifying tensions on commodities, especially on food, as well as on the supply chains linked to Ukrainian and Russian production. Simultaneously, inflation, which has been rising month after month, continues to reach record levels and is now spreading to sectors further away from energy prices. The structural nature of this inflation has now been acknowledged by central banks, and prompt intervention by them is, in our view, necessary to curb the rise in prices.

Chart 1: Breakdown of inflation in the euro area (Source: CACIB Forecast, Bloomberg, May 2022)

In that respect, investors are very cautious on risky assets, anticipating a rapid withdrawal of monetary support policies and a quick rise in key interest rates in the coming months. In the chart below, we can see that the market is now expecting a total of 100 basis points rate hike by the ECB as early as 2022, and another 100 basis points in 2023, even though the APP purchases are not yet complete. It should be noted that the APP should be interrupted in July, just before the first rate hike.

Chart 2: Market forecasts of interest rate hike in the Eurozone (Source Bloomberg, May 2022)

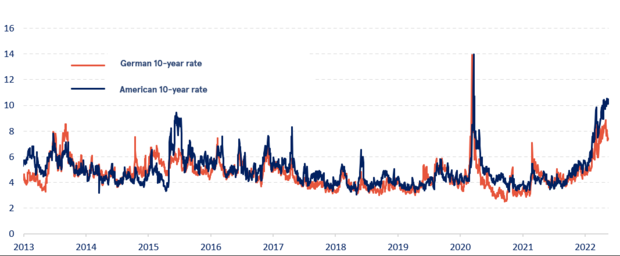

The size and pace of these rate hikes will certainly depend on the path of future inflation and its impact on the economy, which are very difficult to predict at the moment. As a result, rate volatility has reached historically high levels, the likes of which have not been seen for more than 10 years except for the March 2020 peak, as shown in the following graph of the implied volatility of the German Bund (blue curve) and US Treasuries (red curve).

Chart 3: Implied volatility, in % (Source Bloomberg, May 2022)

As we have seen, taking a directional view on interest rates is particularly perilous given the uncertainties about the path of inflation. And while we haven't seen rates on this high level since 2014 in the eurozone, inflation is breaking decades-old records, when nominal rates were near 10%....

In this unusual macroeconomic context, what about the impact on company fundamentals and on the evolution of credit margins?

CORPORATE FUNDAMENTALS

While we can reasonably expect a deterioration in issuers' credit fundamentals in today’s environment (slowing revenue growth, deteriorating operating margins and cash generation), in an environment where growth is slowing, it is worth noting that issuers are entering this period of "turbulence" with extremely strong credit fundamentals, including healthy credit ratios, high level of cash on balance sheet (see chart below), and relatively low short-term maturity wall. As a result, we believe that issuers will be able to absorb this deterioration in credit fundamentals without causing a significant increase in default rates.

Download the PDF to know more