By François Rimeu, Senior Strategist, Crédit Mutuel Asset Management Crédit Mutuel Asset Management is an asset management company of Groupe La Française, the holding company of the asset management business line of Credit Mutuel Alliance Fédérale.

The prospect of witnessing the United States distancing itself from its historical allies seems to be a reality today. Recent statements from the Trump administration suggest that the United States intends to treat Europe as “just another” trade partner rather than a strategic ally.

For Europe and the rest of the world, this greatly challenges the post war stability upon which the Old Continent relied to become the world’s largest free trade zone. The awakening is brutal, highlighting Europe's dependence on the United States for security. Current discussions between Europe’s key Heads of State suggest they are beginning to grasp the extent of the transformation unfolding before them and the choices that will have to be made in the coming months. The European Union has historically been marked by strategic differences based on the economic and geopolitical interests of its member states. Unfortunately, the current crisis may not be enough to overcome these longstanding divisions.

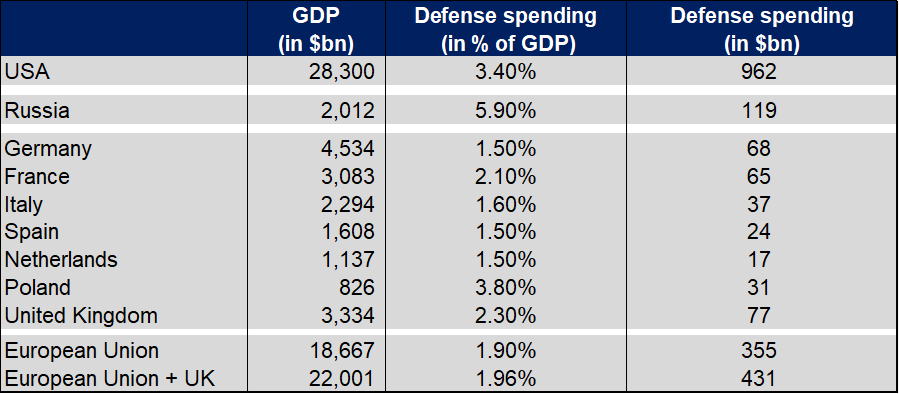

In 2023, the United States spent about 3.4% of its GDP in security and thus defense spending, amounting to roughly $962 billion, while Russia on the other hand allocated 5.9% of its GDP, or about $118 billion. (Sources: World Bank, Bloomberg, end 2023)

What about Europe?

As illustrated in the table below, there are clear disparities, with the European Union spending about 1.9% of its GDP, around $355 billion, or $431 billion if the UK, which is currently taking part in the discussions, is included. By way of comparison, China’s defense spending reached $296 billion in 2023 (1.7% of its GDP).

Source: World Bank, Bloomberg, as of end of 2023

For several months now, the Trump administration has issued numerous statements on this matter mainly directed towards NATO member countries. They have repeatedly stated that each country should allocate at least 2% of its GDP to defense spending, in line with a guideline established in 2006. In 2023, only 23 of the 32 member states complied with this rule. The US president has even spoken about wanting the 5% mark to be reached.

All of this should push European countries, gradually and no doubt with difficulty, to increase their defense spending in the medium term. There are already discussions aiming at removing these expenditures from European debt calculation rules. It is therefore not far-fetched to imagine that defense spending could reach between 2.5 % and 3 % of the GDP of European Union countries within a few years.

Of course, we cannot predict how relations between the current major powers will evolve, and maybe everything we have just mentioned will be irrelevant in the coming months. Nevertheless, a scenario that would require significantly higher defense spending in the European Union does not seem unrealistic at this stage.

Academic research does not show a strong correlation between defense spending and investment, and consequently economic growth as many parameters come into play (Source: Defense Spending and The Economy, Gordon, Adams and Gold, 1987). However, although not all papers agree, an increase in defense budgets could lead to higher inflation, even if it is only temporary (Source: A reexamination of the effect of rapid military spending on inflation, Nourzad, 1987).

In this scenario, it is likely that inflation expectations would rise, and nominal rates would not be able to decrease due to sustained nominal growth, which would favor real rates over nominal rates. Defense contractors would experience an increase in demand, boosting their profitability. Ultimately, this only reinforces our conviction regarding gold, which once again appears to be a safe haven asset. Beyond central bank purchases or the hedge it provides against inflation risk, the likelihood of a change in the ‘global order’, as rarely seen in history, is probably the main argument in favor of gold today.

This commentary is provided for information purposes only. The information contained in this publication is based on sources we consider reliable, but we do not guarantee their accuracy, completeness, validity or relevance. This non-contractual document does not constitute in any way a recommendation, solicitation of an offer, or an offer to buy, sell, or arbitrate, and should not, in any case, be interpreted as such. Published by La Française Finance Services, registered office at 128 boulevard Raspail, 75006 Paris, France, a company regulated by the Autorité de Contrôle Prudentiel as an investment services provider, n° 18673 X, a subsidiary of La Française. Crédit Mutuel Asset Management: 128 boulevard Raspail, 75006 Paris is a management company approved by the Autorité des marchés financiers under number GP 97,138. Société Anonyme with a capital of €3871680, RCS Paris n° 388,555,021, Crédit Mutuel Asset Management is a subsidiary of Groupe La Française, the asset management holding company of Crédit Mutuel Alliance Fédérale.