by Alger, a La Française partner firm

April 2023 marks the 20th anniversary of the completion of the Human Genome Project, which mapped the complete set of genetic instructions, or DNA, of humans. The human genome determines your eye and hair color and has a profound influence on your risk of developing certain diseases. As research within genomics has started to drive major medical breakthroughs, how might investors be positioned to potentially benefit?

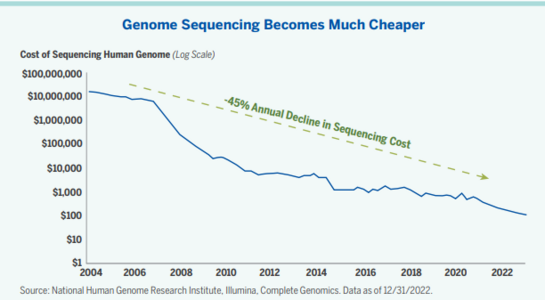

- All living things have a genetic blueprint (DNA) consisting of chemical building blocks called nucleotides. The order of these blocks determines the biological characteristics of living organisms. In the chart above, the cost to read or sequence the three billion bases of the human genome cost over $20 million in 2004, fell to $100,000 in 2009 and with recent new technology iterations is on track to be around $100-200 in the next year or two.1 The noticeable drop in sequencing costs after 2009 was the result of innovation in next-generation sequencing technologies, enabling high-throughput and parallel sequencing.2

- Sequencing is not just about DNA but encompasses RNA (ribonucleic acid, the molecule tha ttranslates DNA code into proteins), proteomics (the study of proteins), and spatial genomics to understand how gene activity varies across different areas of a tissue. For example, by sequencing the COVID-19 virus’s genome, scientists were able to identify its unique characteristics and develop targeted vaccines in a much shorter time frame than traditional methods.

- We believe there are many areas for potential investment opportunities that are tied to genomics. This includes corporations that make DNA sequencing tools and molecular diagnostic products, companies that provide reagents for other consumables, for research and development, DNA testing companies including those in the pre-natal space, select biotech drug development companies, and biologic transportation companies, in our view.

La Française AM Finance Services, in accordance with the terms of an agreement signed with Alger Management, Ltd, is a distributor of the Alger SICAV in Europe.

Download the PDF :