By Céline ZANELLA, Sustainable Investment Research Analyst, Crédit Mutuel Asset Management Crédit Mutuel Asset Management is an asset management company of Groupe La Française, the holding company of the asset management business line of Credit Mutuel Alliance Fédérale.

While it is difficult to establish a direct correlation between natural disasters (droughts, floods, heatwaves, storms, etc.) and climate change, scientific evidence confirms that rising global temperatures increase the likelihood, frequency (multiplied by five since the 1980's1 ) and severity of certain extreme events. And clearly, the clock is ticking, with 2024 being the first year to have recorded an average temperature 1.5° C above that of the preindustrial era.

In parallel, the economic cost, meaning all the financial losses directly attributed to a major event and the losses due to the interruption of business activities resulting directly from material damage, also increase at a higher pace (almost 8x1 compared to the 1980s). According to initial December 2024 estimates by the insurer Swiss Re, the economic cost should reach $310 billion in 20242, up +6% from 2023.

However, this figure may be undervalued. Assessing the impact of these climate events is particularly difficult in low-income countries, especially for slow-onset disasters such as droughts and heatwaves. In addition, indirect costs, such as social costs, are not included in this estimate.

These events incur considerable social costs which include human loss and suffering (both physical and mental health problems), the displacement of populations, the loss of cultural heritage and the disruption of livelihoods. These weather-related events are also driving up insurance and healthcare costs. They accentuate existing inequalities, especially among the most vulnerable populations, within and between countries.

These inequalities highlight the urgency of climate change adaptation, while underlining the importance of climate justice. Indeed, this concept refers to the disproportionate impact of climate change on populations, beyond just environmental or physical impacts.

The economic impact is generally greater in absolute terms in high-income countries as the economic value of infrastructure and housing tends to be higher. These countries are also more likely to be covered by insurance systems, making the financial impact easier to quantify. For example, initial estimates suggest that the Los Angeles wildfires of January 2025 could result in over $250 billion in economic losses , representing roughly 6% of California's projected GDP for 2024.

In contrast, social consequences are typically higher in low-income countries but less quantifiable. These populations have fewer assets, less insurance coverage and generally a limited access to public services. For example, Typhoon Yagi, which violently hit Southeast Asia (Vietnam, Philippines, Laos, Myanmar, Thailand) in September 2024, was reported to have caused $12.6 billion4 in economic losses across the region, roughly 4% of the region's average GDP for 2023. The storm also took more than 800 lives, damaged thousands of schools and healthcare centres and had major consequences on access to drinking water and sanitation, the condition of crops, and access to education...

Another way to address these inequalities is by taking a closer look at the issue of insurance coverage. In 2024, only 44 %2 of natural disaster losses were covered by insurance. However, the increasing frequency and intensity of these events have led to two major phenomena in recent years: the withdrawal of some insurers from high-risk areas and the increase in insurance premiums in these regions. For example, following the recent Los Angeles wildfires, State Farm, California's largest insurer, sought approval from regulators to increase insurance premiums by an average of 22%5 . While the objective was to support the company's solvency, these measures are often taken to discourage populations and businesses from staying in these vulnerable areas. However, this situation particularly penalizes the most vulnerable populations, who cannot afford insurance or relocate. The lack of insurance coverage also undermines the credit profile of borrowers, including businesses, making the reconstruction phase more difficult. It also highlights inequalities between countries.

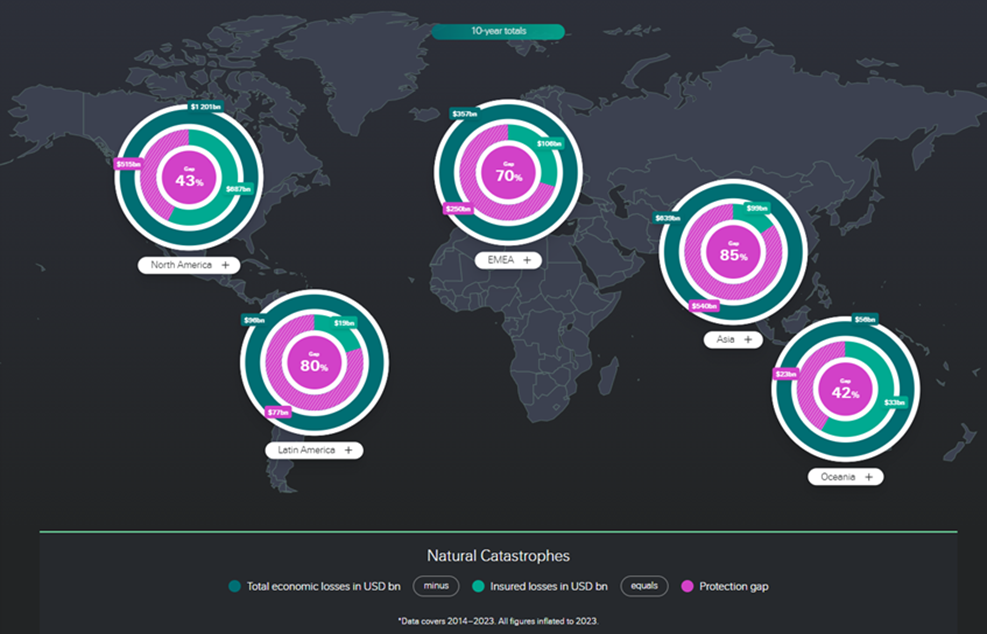

Indeed, according to data gathered by Swiss Re6 over a 10-year period, between 2014 and 2023 (see below), the ‘protection gap’ linked to natural disasters, which refers to the difference between insured and uninsured losses, is much greater in Asia (85%) and Latin America (80%) as opposed to North America (43%). The gap is also significant for the EMEA region (70%), where it is larger in emerging countries than in advanced countries: a deficit of $48 billion in 2023 (+20% compared to 2013) versus $26 billion (+13%) respectively. Indeed, in emerging markets, some regions have close to no coverage against natural disaster risks.

Source: Swiss Re - How big is the protection gap from natural disasters where you are?

Governments often intervene as a last resort to cover the cost of uninsured losses. For example, the Spanish government committed over €10 billion7 in funding for reconstruction after flooding hit Valencia in October 2024. It also acknowledged the need to implement a long-term plan to transform the area and adapt it to the challenges of the climate emergency affecting the Mediterranean basin.

Indeed, to gear up for future challenges, governments need to take proactive measures to assess vulnerabilities. Together with businesses and investors, they must invest in adaptation and resilience (quality of infrastructure, preservation of vital resources, etc.), which, according to the UN, accounts for only 21% of international climate financing8 .

Governments can also address inequalities by providing financial support to vulnerable populations. They should take action by promoting insurance coverage and the establishment of micro insurance systems, which would reduce the impact of shocks on public finances. And for businesses, it means adjusting their practices to reduce their environmental impact, while involving the upstream part of the value chain, workers and local communities to ensure a just transition.

This commentary is provided for information purposes only. The information contained in this publication is based on sources considered reliable, but Groupe La Française does not guarantee their accuracy, completeness, validity or relevance. Published by La Française Finance Services, registered office at 128 boulevard Raspail, 75006 Paris, France, a company regulated by the Autorité de Contrôle Prudentiel as an investment services provider, n° 18673 X, a subsidiary of La Française. Crédit Mutuel Asset Management: 128 boulevard Raspail, 75006 Paris is a management company approved by the Autorité des marchés financiers under number GP 97,138. Société Anonyme with a capital of €3871680, RCS Paris n° 388,555,021, Crédit Mutuel Asset Management is a subsidiary of Groupe La Française, the asset management holding company of Crédit Mutuel Alliance Fédérale.

1Barclays, Sustainable Investing Research - Winter update 2024: What's up with the extreme weather?

2Hurricanes, severe thunderstorms and floods drive insured losses above USD 100 billion for 5th consecutive year, says Swiss Re Institute | Swiss Re (December 2024)

3Los Angeles Times, Estimated cost of fire damage balloons to more than $250 billion

4Counting the cost 2024, a year of climate breakdown, Christian Aid (December 2024)

5Los Angeles Times, State Farm seeks emergency rate increase averaging 22% after L.A. fires

6Swiss Re, sigma Resilience Index 2024

7Les Echos, In Spain, the government releases 10 billion euros for flood victims

8United Nations, Climate Action Fast Facts