AI is driving up demand for GPU chips and infrastructure investment, as data centers may require x7 more power. The risk of under-investing is greater than the risk of over-investing.

Electric vehicles requires 2x more electronic components.

As the multi-expertise asset management division of Crédit Mutuel Alliance Fédérale, we gather a number of complementary asset management companies, covering a complete and diverse asset classes expertise. Within this asset management division, Crédit Mutuel Asset Management (CM-AM) offers a large range of investment solutions for retail, corporate and institutional clients.

*IPE Top 500 ranking

A proven stock-picking strategy based on key trends.

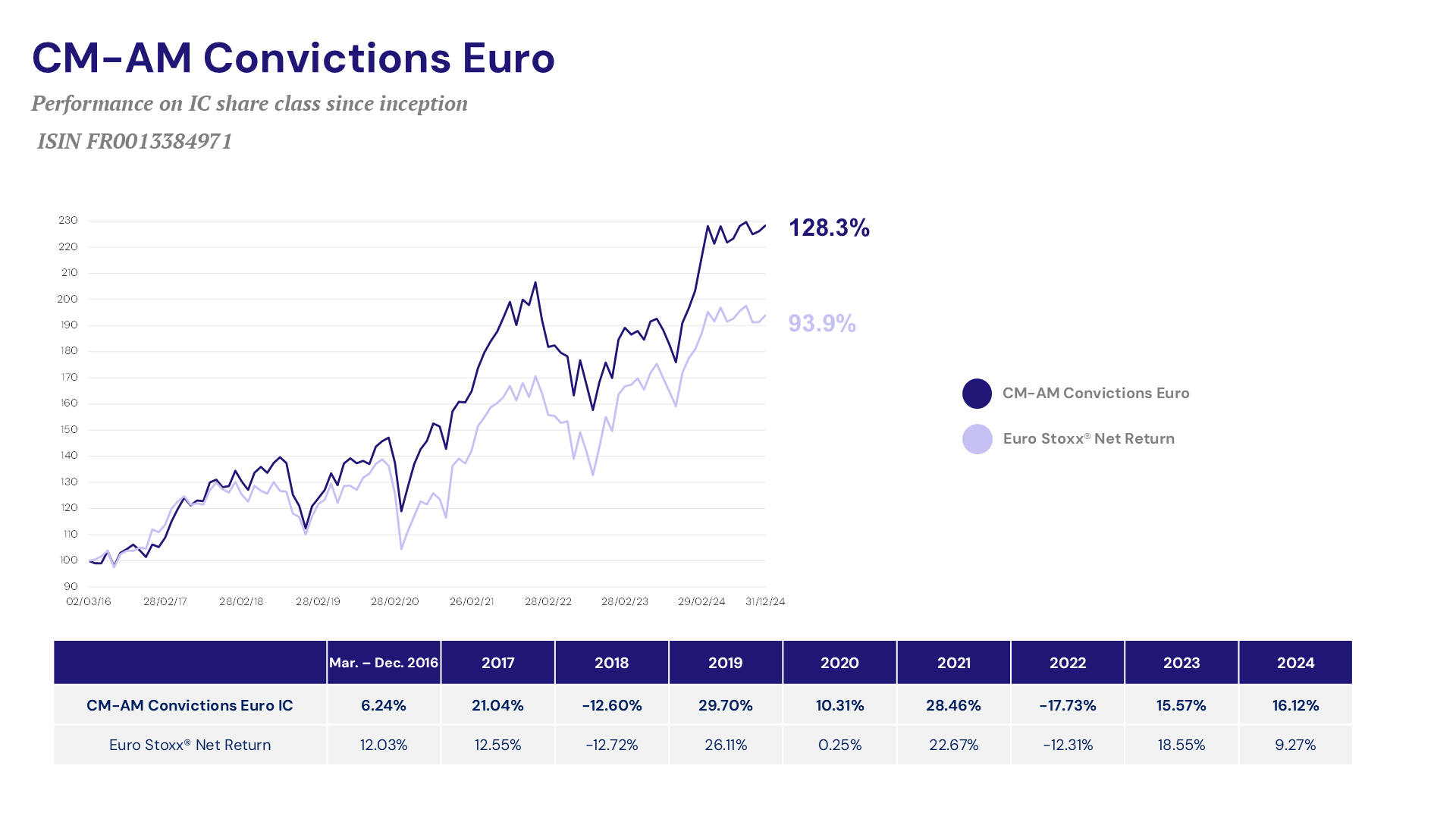

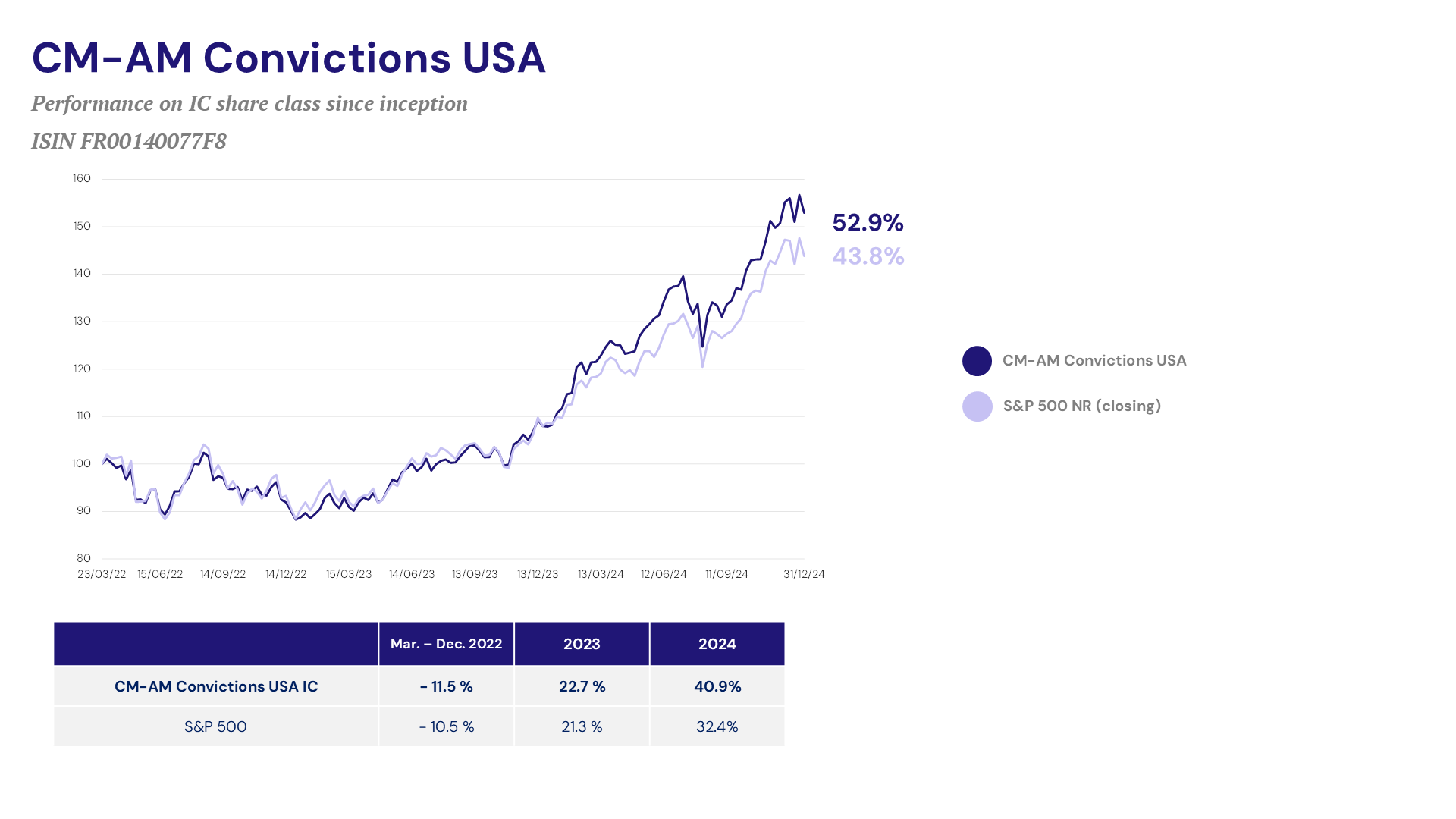

The range includes 2 high-conviction equity funds: CM-AM Convictions Euro and CM-AM Convictions USA, which focus on supporting the growth of companies considered as value-creating companies in Europe and in the United States.

« We invest in business models that are understandable, sustainable, and well-positioned in attractive sectors.

Our management style is proactive and based on strong convictions. We adapt this style to suit market conditions. Our core portfolio is focused on quality and growth. We also have a diversification pocket designed to capture market opportunities and enhance potential performance.»

Jean Louis Delhay

CIO of Crédit Mutuel Asset Management and Lead Manager of the Convictions funds range

The CM-AM Convictions fund range is aligned with four core transformative trends that are shaping the future.

AI is driving up demand for GPU chips and infrastructure investment, as data centers may require x7 more power. The risk of under-investing is greater than the risk of over-investing.

Electric vehicles requires 2x more electronic components.

Emerging consumers: +800M middle class consumers by 2030 in EM countries. (+190M India, +50M Indonesia, +275M China).

Asia accounts for a third of global luxury market and will gain 1.2Bn more urban residents by 2050.

Infrastructure investments needed for:

According to the WHO, 1bn people suffer from obesity. A chronic disease that puts an increasing risk of other complications such as Type 2 diabetes.

By 2050, 2bn people will be over 60, and 50% of the population will have myopia.

The investment team considers ESG criteria at every stage of the investment process, in line with our commitment to give finance a meaningful purpose. We actively monitor two key indicators: carbon intensity and gender diversity on boards.

CM-AM Convictions funds range is classified Article 8 according to the SFDR regulation*.

* SFDR classification doesn’t guarantee funds’ performance.

Almost 20 years of proven experience across market cycles, supported by a stable team.

Jean-Louis DELHAY

CIO Crédit Mutuel Asset

Management and Lead

Manager of the

Convictions funds range

Jean-Luc MENARD

Head of Convictions

Management Team

Estelle BARDY

Fund Manager

Valentin VERGNAUD

Fund Manager

The fund stands out for its defensive profile: it has navigated the European equity landscape and shown resilience during market fluctuations.

CM-AM Convictions Euro main risks: capital loss risk, equity market risk, discretionary management risk, liquidity risk, small-cap equities, sustainability risk.

Past performance is not a guide to future performance. The EURO STOXX® Net Return Index is expressed at closing with dividends reinvested. Performance is net of management fees.

SOURCE: SIX as of 31/12/2024

CM- AM Convictions USA main risks: capital loss risk, equity market risk, discretionary management risk, liquidity risk, small-cap equities, sustainability risk.

Past performance is not a guide to future performance. The S&P 500 Net Return Index is expressed at closing with dividends reinvested. Performance is net of management fees.

SOURCE: SIX as of 31/12/2024

Creating and offering targeted investment solutions on behalf of third parties has been the mission of Groupe La Française for over 40 years.

Marketing communication for non-professional clients within the meaning of MiFID 2.

Past performance is no guarantee of future results

For a full description of the risks and further information on the strategies and all fees, please refer to the current prospectus and key information document available onon our website. The policy relating to customer inquiries and complaints implemented by Groupe La Française is available on our website.

It does not constitute an offer or investment advice. Non contractual information considered to be accurate at the date of publication and likely to change over time. Crédit Mutuel Asset Management declines all responsibility for any alteration, deformation or falsification of this communication. Any reproduction or modification of this document is strictly prohibited without the express authorisation of Crédit Mutuel Asset Management.

SRI Charter and transparency codes available at www.la-francaise.com

Source: Groupe La Française, January 2025.

Crédit Mutuel Asset Management: 128, boulevard Raspail 75006 Paris. Asset management company approved by the AMF under number GP 97 138. Société Anonyme (public limited company) with share capital of euros 3871680 registered with “RCS de Paris” under number 388 555 021 APE code 6630Z. Intra Community VAT: FR 70 3 88 555 021. Crédit Mutuel Asset Management is a subsidiary of Groupe La Française, the asset management holding company of Crédit Mutuel Alliance Fédérale.

La Française AM Finance Services, an investment firm approved by the ACPR under number 18673 (www.acpr.banque-france.fr) and registered with ORIAS (www.orias.fr) under number 13007808 on 4 November 2016.

Address of the local paying agent: Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, 1010 Vienna Austria, Belgium: Caceis Belgium SZ, Avenue du Port / Havenlaan 86C b 320 B-1000 Brussels, Germany: ISS Facility Services Holding GmbH, Theodorstraße 178, 40472 Düsseldorf, Spain: Aldana Capital, Calle Cochabamba, 22, 1-D. Madrid. 28016, Italy: Allfunds Bank, Via Bocchetto, 6, 20123 - MILANO – Italia